|

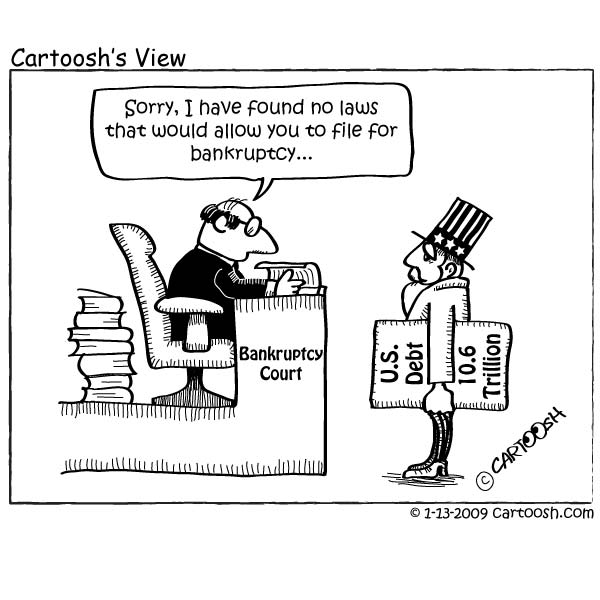

| Drawing courtesy of cartoosh.com |

In re Ochoa concerns a debtor who had his truck repossessed by Long Valley Financial Services then declared bankruptcy. Mr. Ochoa offered Long Valley a plan to assure them he would make payments on the truck including monthly payments. Nonetheless, Long Valley sold the truck at auction, notwithstanding several statements by its counsel that it would return the truck to Mr. Ochoa. Now Mr. Ochoa's counsel seeks sanctions against Long Valley for violating the automatic stay by "exercising control" over property of the bankruptcy estate - Mr. Ochoa's truck. Bankruptcy Judge Charles Novack explained that sanctions were appropriate for the violation of the automatic stay but, In re Dyer (9th Cir. 2003) created limits, "We have never authorized punitive (i.e. criminal) sanctions under the contempt authority of § 105(a)." According the contempt sanction was limited to fees and costs.

In Wu v. Kelman, the bankruptcy trustee moved for summary judgment that a series of loans made and later forgiven by a company before filing a bankruptcy petition were either 1) not subject to forgiveness 2) corporate waste or 3) voidable under California law. The president of the company gave a series of loans to his sons which would be forgiven if they worked for the company for a designated period of time. The sons fulfilled the obligation and the president wrote "PAID IN FULL" on each promissory note. Judge Arthur S. Weissbrodt stated that this was enough to raise an issue of fact as to whether the loans were a sham and would hear the matters at a trial.

7B2947D342

ReplyDeletehacker kirala

hacker arıyorum

tütün dünyası

hacker bulma

hacker kirala